Our clients speak out

What to expect from Your Free Consultation

LEGAL SOLUTIONS AT VAN HORN LAW GROUP

Our Board Certified Bankruptcy Attorneys Can Help You Find The Best Legal Solution For Your Situation

Our Board-Certified Bankruptcy Attorneys Help You Find the Best Path Forward At Van Horn Law Group, we deliver practical, results-driven strategies that reduce stress and help you regain control of your finances quickly. Our experienced bankruptcy attorneys serve clients across Fort Lauderdale, Miami-Dade, Palm Beach, and Orlando, Florida, and our expanding team in Pittsburgh, Pennsylvania proudly brings that same trusted support to individuals and families throughout Western Pennsylvania.

Van Horn Law Group takes a different approach to helping clients overcome financial challenges. We guide people through bankruptcy, debt relief, and foreclosure defense with clarity, compassion, and proven results, even in the most complex cases. Our Florida-based attorneys thrive where others hesitate, and our Pittsburgh office extends that commitment to clients seeking a fresh start across Western Pennsylvania.

Across South and Central Florida, our attorneys have built a reputation for achieving positive outcomes where others fall short. With offices in Orlando and Pittsburgh, we continue to deepen our connection to the communities we serve by offering pro bono representation, donating time and resources, and supporting causes that strengthen families and neighborhoods in both Florida and Western Pennsylvania.

-

personal bankruptcy

Personal bankruptcy can eliminate credit card debt, medical bills, and more through Chapter 7 or Chapter 13 while protecting your property.

-

BUSINESS BANKRUPTCY

Business bankruptcy can help reorganize under Chapter 11 or liquidate under Chapter 7 to resolve debts and protect your personal liability.

-

SUBCHAPTER V BANKRUPTCY

Subchapter V bankruptcy helps small businesses reorganize faster and cheaper under Chapter 11 while keeping control of operations and assets.

-

DEBT solutions

Our attorneys find debt solutions like negotiation, settlement, or bankruptcy to stop lawsuits, eliminate debt, and protect your future.

Over 100 Awards & Recognitions

-

6500+Chapter 7

Bankruptcy Filings -

280+Chapter 11

Bankruptcy Filings -

2800+Chapter 13

Bankruptcy Filings -

9800+Total

Bankruptcy Matters -

99%Discharge Rate

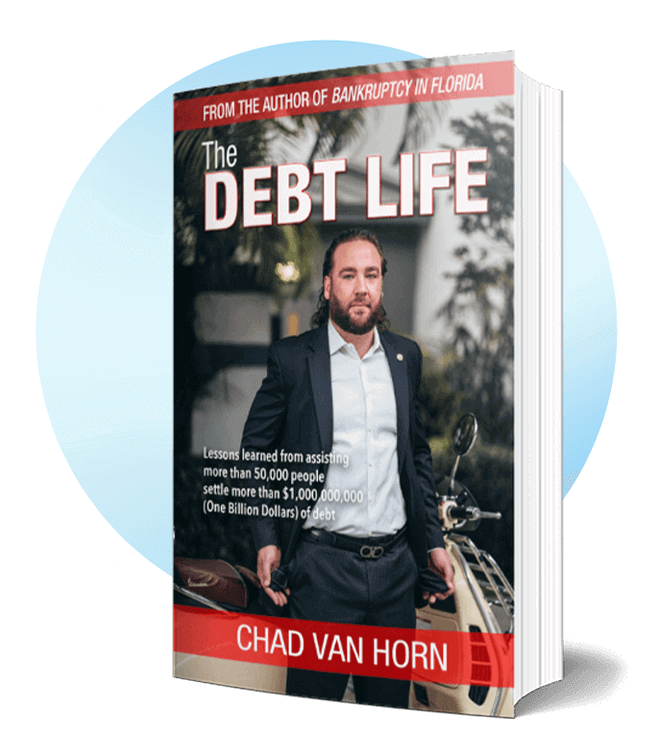

The Debt Life

Check out Chad Van Horn’s 2020 best-selling book, The Debt Life, a collection of true stories that display proven techniques to reduce the burden and stress caused by debt. This incredible book landed on Amazon’s bestseller list within a mere 24 hours of going on sale. Van Horn discusses practical solutions to help businesses and individuals find their way beyond “the debt life” into financial stability and better peace of mind.

The Debt Life covers a wide range of financial issues, including gambling, credit card debt, unexpected medical expenses, shopaholism, divorce, student loans, and real estate flipping. Van Horn also explains tips and techniques to get out of debt, including negotiation, budget trimming, consolidation, debt management, and bankruptcy options.

Get Free ResourcesWhat Makes Van Horn Law Group Different

Dedication. Experience. Results. No matter how complex the issue, our student loan lawyers and bankruptcy attorneys in Fort Lauderdale, Miami-Dade, and Palm Beach use their experience, legal knowledge and techniques to achieve the best possible outcome for you or your business. We also proudly serve clients from our new offices in Orlando, Florida and Pittsburgh, Pennsylvania, bringing the same commitment and expertise to these communities.

Van Horn Law Group is the largest bankruptcy firm in Broward County based on cases filed over the last 12 months (www.pacer.gov) and one of the top bankruptcy filers in the country. Our firm also has ranked among Inc. magazine’s 5,000 fastest-growing, privately held companies in the U.S. in 2019 and 2020.

Ready to Be Our Next Success Story?

Meet Our South Florida and Western Pennsylvania Legal Team

The Van Horn Law Group team includes some of the best student loan lawyers and bankruptcy attorneys in Fort Lauderdale, Miami-Dade, and Palm Beach, providing trusted legal guidance to clients across South Florida. Our attorneys in Fort Lauderdale, West Palm Beach, Miramar, Doral, North Miami, and Miami Lakes are multilingual in English, Spanish, and Creole and are dedicated to helping you gain freedom from debt and achieve a financial fresh start.

With our growing presence in Pittsburgh and Western Pennsylvania, we are proud to extend that same trusted experience and client-focused approach to more individuals and families seeking financial relief. Take a moment to get to know our team — highly skilled professionals with years of experience dedicated to providing clear, practical, and compassionate legal solutions.

Frequently Asked Questions

If you are struggling with your finances, then bankruptcy might be the way to go. We recommend working with our bankruptcy attorneys in Miami-Dade, Broward, and Palm Beach to learn more about bankruptcy and other debt solution options and determine what is the right option for you. We also proudly serve clients in Orlando, Florida, and Pittsburgh, Pennsylvania, offering guidance tailored to your community. Here are some answers to our most commonly asked questions to help you make better and more informed decisions about your legal case.

-

Personal Bankruptcy FAQ

How long does filing a Chapter 7 personal bankruptcy typically take?The entire Chapter 7 bankruptcy process typically takes about four to six months from credit counseling to the point when the court discharges the rest of your debts. Your bankruptcy can take longer if the trustee asks you to submit additional documents or sell your property. -

Business Bankruptcy FAQ

How does a Chapter 7 corporate bankruptcy work?A Chapter 7 business bankruptcy does not enable the continued operation of an LLC or corporation, so you need to shut down your company. After you file the business bankruptcy, the trustee will sell your business assets and send the proceeds to your creditors and collectors. -

Loan Modification FAQ

What is loan modification?Loan modification refers to a change that a lender makes to the current loan terms, including a different kind of loan, an extension of the amount of time for repayment, a decrease in the interest rate, or a combination. Borrowers usually work with an attorney or company to negotiate. -

Student Loan Debt FAQ

What are my student loan repayment options?There are several different repayment options and debt solutions out there for student loan debt, depending on the kind of loans you have and your goals for paying off your student loans. We recommend consulting with bankruptcy attorneys at the Van Horn Law Group.